Need an Okash loan in Nigeria? Learn how to apply and get up to N100,000 with low interest rate, repay in 3 - 12 months without collateral, directly to your bank account. Okash was first launched in Kenya and it allows them to borrow up to Kes 500,000. Before arriving in Nigeria and now Nigerians can also apply for a loan through the okash personal loan app.

I have written a lot about loan lending platforms in Nigeria where you can get quick loans without collateral. But in today's article, we are going to concentrate on the issues at hand which is okash loan, how to apply and so on.

Tables of content

The app based loan platform Okash, utilizes artificial intelligence technology to determine the purpose of the loan together with the repayment behaviour of its users.

I have written a lot about loan lending platforms in Nigeria where you can get quick loans without collateral. But in today's article, we are going to concentrate on the issues at hand which is okash loan, how to apply and so on.

Tables of content

- Okash loan

- How it works

- Reasons to trust okash

- Loan Requirements Form

- Are my bank/BVN secured?

- How To Apply For A Loan

- Interest rate

- Repayment Channels

- Contact Details

- Conclusion

Okash Loan

Okash is an instant personal loan application for Nigeria mobile users, presented by Blue Ridge Microfinance Bank Ltd. You can apply for a loan and get up to N50,000 upon downloading and installing the Okash app from Google play store.

Also Read: Run Out Of Data? Learn How To Check Or Subscribed To MTN Data Plan

Also Read: Run Out Of Data? Learn How To Check Or Subscribed To MTN Data Plan

The app based loan platform Okash, utilizes artificial intelligence technology to determine the purpose of the loan together with the repayment behaviour of its users.

How Okash Loan Works

- Download and install the Okash app from Google play store

- Apply for a loan

- Receive your loan

- Repay your loan at when due

Reasons To Trust Okash Loan App

Here are the top reason you have to trust okash while applying for a loan from them

- It is fast, secured, reliable and easy to use

- Okash has a dedicated team

- Loan disbursement takes place within 5 minutes of applying

- 24/7 customer support system

- No collateral

- No hidden charges

- It allows you to borrow up to N500,000 once you repay your loans at its due date.

Okash Loan Requirements Form

- You must be a Nigeria resident

- You must have a monthly source of income

- You must not be less than 20 years or above the age of 55

- You must have a bank account where your money will be disbursed

- You must provide your BVN to verify that the individual seeking for the loan is the same as the owner of the registered bank account.

Are My BVN/Bank Details Secured When Applying For A Loan On Okash App?

According to okash privacy policy, they promise not to disclose your personal information with any third parties without your approval/consent. So be 100% certain that your information is totally safe with them.

Also Read: Transfer, Pay Bills And Perform Other Banking Activities With UBA Transfer Code

Also Read: Transfer, Pay Bills And Perform Other Banking Activities With UBA Transfer Code

How To Apply For A Loan On Okash In Nigeria

Follow these steps in other to successfully apply for a loan:

- Download and install the Okash app from Google play store

- Create an account with the phone number linked to your bank account

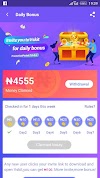

- Based on the loan limit displayed on your screen, select the amount of loan you wish to apply

- Select your loan repayment schedule and check its interest rate

- Fill out your basic information, then submit your application

- After the submission, a notification message or call from Okash will arrive for approval

- E-sign the loan agreement after the approval

- After the E-sign, the approved loan amount will be disbursed into your bank account within 5 minutes and a SMS notification will be sent.

Note: Okash will access your mobile device for the permission of (but not limited to) contacts, location, SMS, calendar and camera to determine your loan offer and it's interest rate. It is a very important part of evaluation process

A N15 deduction fee might be charged from your bank account when granting you a loan.

Okash Loan Interest Rate

By using the okash loan app, you can access a loan starting from N5,000 to N50,000 with terms from 3 to 12 months, with a monthly interest rate ranging from 0.6% to 20%.

Also Read: How To Save And Invest Money On Piggyvest In Nigeria

Also Read: How To Save And Invest Money On Piggyvest In Nigeria

However, as a first time user, you can access a loan ranging from N5,000 to N50,000. However, your loan cap increases as you pay up your loans at when due and build trust with the system. Early repayment guarantees higher amount and lower interest rates.

Okash Loan Repayment Channels

It's your loan approaching it's due date? If yes then, you have nothing to worry about. Because Okash has made it as easy as possible for you to repay your loan at its due date through the use of their auto debits system which automatically deducts your money from the bank account you submitted when applying for a loan. Make sure your card has sufficient balance before your loan due date.

However, you can choose to repay your loan by yourself by applying this steps:

- Login to the okash personal loan app

- Click on the "Make a Repayment" button

- Pay or transfer to this account: Blue Ridge Microfinance Bank Ltd. Bank Name: Zenith. Account Number: 1130085518.

- Fill in your BVN or your registered phone number and your full legal name in the remarks section

- Send the transfer details to Repayment.proof.ng@o-kash.com

- Within minutes, your loan repayment will be verified.

Okash Loan Contact Details

For complain, issues or queries please don't hesitate to reach out to them by dialing this numbers:

+2348097755512

+2348097755514

Or you can send them a mail through support@o-kash.com for further assistance.

Head Office

Room 301, Japaul House, Plot 8 Dr Nurudeen Olowopopo way, Central Business District, Ikeja, Lagos State, Nigeria.

Conclusion

Okash loan Nigeria is a place to apply and get a loan instantly with no collateral in Nigeria and your loan offer will be disbursed into your bank account within 5 minutes.

Please try to pay your loan on time or at its due date to increase your loan offers and also to avoid facing any penalties as you will be reported to the national credit bureaus (NCB).

0 Comments