Need a loan? Here are a list of the best loan apps in Nigeria where you can get quick loans without collateral immediately you downloaded and installed these loan apps from Google play store.

Seeking for a loan through bank is hard and stressful, and even if they do, they are going to request you to fill out a loan application form and even request for a collateral (land, property, house etc) before granting you a loan.

But thanks to this fintech company, getting an online loan becomes easier as it can be done right from the comfort of your home, office or work with the use of your internet connected device without visiting any bank.

But there are some online loan lending platforms in Nigeria that allows you to apply for a loan, not through its web portal, but through it's app.

In this article, am going to discuss about this following loan apps in Nigeria:

Paylater, now known as carbon, is an online loan lending platform in Nigeria where you get a quick loan up to N1 million with no collateral within 5 minutes if being accepted directly to your bank account.

Paylater is a service provided by one finance and investments Ltd with RC no. 1044655. A finance company licensed and regulated by the central bank of Nigeria.

You can request for a loan upon downloading and installing the carbon(paylater) loan app from Google play. Click here to know more about carbon(paylater) loan.

Quickcheck is a Nigerian fintech company that gives out loan of up to N500,000 to Individuals without collateral instantly if being accepted, directly to your bank account.

Quickcheck are fully devoted to ensuring their users are supported in micro lending. So, Never go broke again. No long queues, no wasting of time.

You can request for a loan upon downloading and installing the quickcheck loan app from Google play store. Click here to know more about Quickcheck loan.

But thanks to this fintech company, getting an online loan becomes easier as it can be done right from the comfort of your home, office or work with the use of your internet connected device without visiting any bank.

But there are some online loan lending platforms in Nigeria that allows you to apply for a loan, not through its web portal, but through it's app.

In this article, am going to discuss about this following loan apps in Nigeria:

- Moneypal by Zedvance

- Carbon (Paylater)

- Quickcheck

- PalmCredit

- Aella Credit

- Sokoloan

- Branch

- Page financials

- Fairmoney

Best Loan Apps In Nigeria 2020

Here are the list of the best loan apps to get quick loans in Nigeria

Moneypal by Zedvance

Zedvance limited is a consumer finance company founded in Nigeria in the year 2014. They provides cash loans to individuals and groups without collateral in the most efficient and convenient manner and also provide travel loans to people who wish to travel abroad for education or business purposes.

Also Read: All About Fast2earn Platform In Nigeria And How To Make Money From It

Also Read: All About Fast2earn Platform In Nigeria And How To Make Money From It

Zedvance offers a loan of up to N5million with low interest rate to its users, with its repayment period ranging from 3 to 18 months period upon downloading and installing it's loan app. To know more about the zedvance loan app click here.

Carbon(Paylater)

Paylater, now known as carbon, is an online loan lending platform in Nigeria where you get a quick loan up to N1 million with no collateral within 5 minutes if being accepted directly to your bank account.

Paylater is a service provided by one finance and investments Ltd with RC no. 1044655. A finance company licensed and regulated by the central bank of Nigeria.

You can request for a loan upon downloading and installing the carbon(paylater) loan app from Google play. Click here to know more about carbon(paylater) loan.

Quickcheck

Quickcheck are fully devoted to ensuring their users are supported in micro lending. So, Never go broke again. No long queues, no wasting of time.

You can request for a loan upon downloading and installing the quickcheck loan app from Google play store. Click here to know more about Quickcheck loan.

PalmCredit

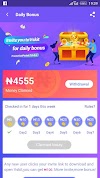

PalmCredit is a newly developed Android application (APK) and one of the, if not the best short term loan app in Nigeria that provides fast loan without collateral to individuals upon downloading and installing it's loan app from Google play store.

Also Read: How To Logout Of Facebook Messenger (Full Guide)

PalmCredit is owned by Transsnet Financial Ltd and operates in Nigeria with a better plan to expand to other countries in Africa. Although they are relatively new, they have made a name for themselves and grown larger user base due to the flexibility of their app and loan structure. You can apply for your credit limit in minutes, then take as many instant loans as you wish without further approval steps. It's a credit revolution! As soon as you repay a loan with PalmCredit, your credit score will be updated thereby allowing you to borrow up to N100,000 next time you choose to borrow.

PalmCredit app is one of the best loan app in Nigeria. Click here to know more about the PalmCredit loan.

Aella credit is a fintech company, unlike PalmCredit, that offers a short term loan of up to N90,000 within 5 minutes to its users directly to their bank account. You can access for a loan upon downloading and installing it's loan app from Google play store. Click here to know more about this loan platform.

Soko lending company limited also known as sokoloan, is a microfinance institution that provides short term loans in Nigeria through its app. It provides financial services to low income entrepreneurs, grassroots employees of SMEs, women with entrepreneurial needs, students who continue to learn, shoppers with consumer needs, customers with fixed assets mortgage, traders and small scale farmers. You can apply for a sokoloan loan in Nigeria anytime with their quick application process that lets you know your application status within 5 minutes all through the app.

Sokoloan App allows you to borrow money up to N30,000 with an interest rate ranging from 4.5% to 34% to pay back in 2 to 6 months.

Page financials loan primary repayment channels is through REMITA for ease of repayment and reconciliation. While their secondary repayment channels is through direct debit mandate (DDM), online repayment or through cheques.

To know more about page financials loan in Nigeria click here.

Fairmoney is a licensed online lending platform In Nigeria and France, that provides fast, secured, reliable and free Android banking app, that make getting loans and paying bills fast and easy and also pays you a commission for each friends you refer. With Fairmoney app, you get a short term loan of up to N150,000 instantly with low interest rate directly to your bank account.

Please, when given a loan, try to repay at when due to increase your chance of getting higher amounts and also to avoid any penalties.

Also Read: How To Logout Of Facebook Messenger (Full Guide)

PalmCredit is owned by Transsnet Financial Ltd and operates in Nigeria with a better plan to expand to other countries in Africa. Although they are relatively new, they have made a name for themselves and grown larger user base due to the flexibility of their app and loan structure. You can apply for your credit limit in minutes, then take as many instant loans as you wish without further approval steps. It's a credit revolution! As soon as you repay a loan with PalmCredit, your credit score will be updated thereby allowing you to borrow up to N100,000 next time you choose to borrow.

PalmCredit app is one of the best loan app in Nigeria. Click here to know more about the PalmCredit loan.

Aella Credit

Sokoloan

Sokoloan App allows you to borrow money up to N30,000 with an interest rate ranging from 4.5% to 34% to pay back in 2 to 6 months.

Branch

Branch is a money lending platform that makes it easy for people in Nigeria, Kenya, Mexico and India to access a loan, anytime, anywhere, through its app without any form of collateral or filling out paperwork. The process of applying for a loan with branch can be done within 5 to 10 minutes and your loan offer will be sent to you directly to the bank account you submitted when applying for the branch loan.

Upon downloading and installing the Branch Loan App You can get up to N200,000, Ksh 70,000, 20,000 pesos or 50,000 rupees. directly to your bank account (Nigeria, Mexico, India) or through MPesa (Kenya). within 24 hours if being accepted and repay at your convenience within 2 to 15 months time.

Page financial

Page international financial services Ltd is simply known by many as page financials, it is among the leading technologically innovative retail finance institution license by the central bank of Nigeria. Which offers outstanding products and services to suit the financial requirements of their diverse clientele. That's according to its web portal. Founded in 2014, and up till now, they have delivered retail financial services in an unprecedented manner to its users.

Also Read: Carry1st Trivia App Reviews, Legit Or Scam? A Must Read

Also Read: Carry1st Trivia App Reviews, Legit Or Scam? A Must Read

They offer loans of up to N5million to its users through its web portal or through its app. According to page financials web portal, it says "there is no fixed interest rate on a loan. The interest rate is dependent on different factors such as the loan amount, tenor, current salary etc".

Page financials loan primary repayment channels is through REMITA for ease of repayment and reconciliation. While their secondary repayment channels is through direct debit mandate (DDM), online repayment or through cheques.

To know more about page financials loan in Nigeria click here.

Fairmoney

Conclusion

These best loan apps in Nigeria can give you quick loans without collateral and your money will be sent to the bank account you provided during registration. But please make sure to use the phone number linked to your account when registering for any of these loans apps in Nigeria.Please, when given a loan, try to repay at when due to increase your chance of getting higher amounts and also to avoid any penalties.

0 Comments